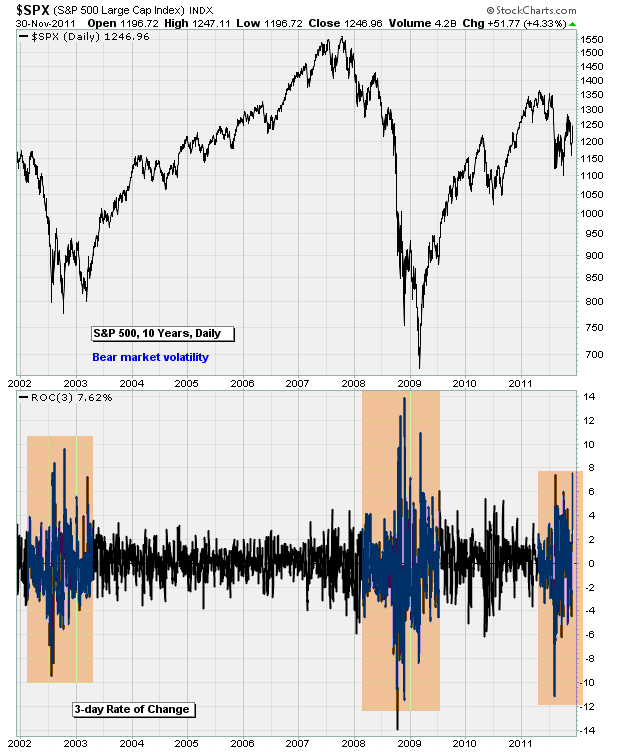

Anthony Mirhaydari - The market has been on crazy pills lately. Massive, bear market type volatility has even the most steel hearted market veterans feeling seasick from the undulations. Adding to the confusion has been some political and economic developments that -- while they make for nice headlines -- mask some serious underlying problems.

Take Friday's big drop in the unemployment rate to 8.6% from 9%, the lowest level since March 2009. The problem is, the number of actual new jobs added in November (120,000) came in under expectations. So the real reason for the drop was that a huge number of people (316,000 to be exact) left the workforce out of frustration and lack of opportunity. rNot exactly good news. It was the same story with Wednesday's European "bailout" by the Federal Reserve -- which I discussed in my last post.

All of this distracts from an emerging truth: The global economy is rapidly falling into a new recession. And the U.S. stock market, despite this week's gains, is showing signs of tipping into a new long-term downtrend. Here's why.

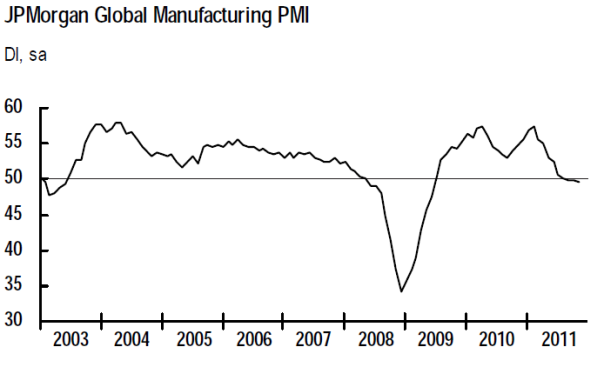

I think the most notable development this week was Thursday's big release of global factory activity surveys. It wasn't pretty. Overall, the JP Morgan Global Manufacturing PMI dropped for the third straight month and fell below the 50 level -- the line of demarcation between growth or contraction in monthly factory activity -- for the first time since recession was descending upon us back in early 2008. Scary stuff.

Although U.S. activity was buoyant (no doubt a remnant of the sentiment tailwinds enjoyed from the market rally in October), we cannot remain an island of tranquility as Asia and Europe fall into the abyss.

Here are the highlights (any reading under 50 indicates a drop in activity):

*Brazil PMI: 48.7 vs. 46.5 prior

*Ireland PMI: 48.5 vs. 50.1 prior

*Sweden PMI: 47.6 v. 49 estimated

*Norway PMI: 48.6 vs. 50.2 estimated

*Denmark PMI: 47.7 vs. 43.6 prior

*Poland PMI: 49.5 vs. 51.7 prior

*Spain PMI: 42.8 vs. 43.9 prior

*Swiss PMI: 44.8 vs. 46.6 estimated

*Czech PMI: 48.6 vs. 51.7 prior

*Italy PMI: 44 vs. 42.8 estimated

*France PMI: 47.3 vs. 47.6 estimated

*Germany PMI: 47.9

*Greece PMI: 40.9 vs. 40.5 prior

*South Korea PMI: 47.1 vs. 48 prior

*Taiwan PMI: 43.9 vs. 43.7 prior

And, now for the big boys:

*Eurozone PMI: 46.4 -- lowest reading since recession ended in July 2009

*U.K. PMI: 47.6 vs. 47 estimated -- lowest since June 2009

*China PMI: 49 vs. 49.8 estimated -- lowest reading since February 2009

*China HSBC PMI: 47.7 vs. 51 prior -- 32-month low

In addition to signs of economic weakness -- which was enough for a Chinese vice finance minster to say the global economy faces a "worse situation" than in 2008 -- there was evidence that the financial system remains under severe stress despite the freak out over Wednesday's move by the Federal Reserve to lower dollar funding costs for foreign banks (which, as I discussed at the time, wasn't really a game changer). The European Central Bank reported that eurozone banks borrowed nearly €9 billion in overnight emergency cash -- up from €2.7 billion earlier this week. Not good.

Other signs of strain could be seen in the way German 12-month bill yields dropped below zero on Wednesday as European investors were willing to pay Berlin for the luxury of lending it money. The motivation is that, if you're holding a big wad of euros, German short-term debt is one of the few "sure bets" left out there. It's a sign of extreme risk aversion and fear.

Of course, the epicenter for all this is Europe.

Adding to concerns were comments this week from new ECB chief Mario Draghi that while downside risks to the economic outlook have increased, he cannot ride to Europe's rescue by engaging in unmitigated money printing and bond buying; instead, it must adhere to its founding principles, including an inability to engage in monetary financing of government debts (exactly what the likes of Italy would love right now).

Draghi's comments were akin to yelling "fire" in a crowded theater before announcing all the fire extinguishers are empty. Whoops.

According to the team at Capital Economics, based in London, the eurozone economy is on track to contract by 1% next year and by 2.5% in 2013, with risks to the downside for both forecasts. Recession will only deepen the budget deficits at the center of the eurozone debt crisis. The only way out is growth. And the only way the likes of Greece, Portugal, and Italy can restore growth is via massive currency depreciation and domestic inflation -- something that's not going to happen as long as they're in the eurozone.

Sure, there will be distractions like Wednesday's move by the Fed or additional stimulus measures out of places like China and Brazil. That's just how the market gods like it. All the better to keep the masses confused and complacent as the fundamentals just get worse and worse.

To put it differently: When you look around the theater, everyone's still focused on center stage blissfully unaware what's happening around them. Turn around. The balcony level is in flames.

I know patience is hard to muster in times of epic volatility, like now. Yet trying to catch the short-term oscillations of a new bear market is a futile effort. Better to lock in defensive positions like cash or Treasury bonds via funds like the iShares 20+ Year Treasury Bond (TLT) before buckling up and grabbing the Dramamine.

For short-term traders and my newsletter subscribers, I continue to recommend a net short positioning. Maybe I'm digging my own grave here, but the clouds on the horizon are too dark to justify anything else.

No comments:

Post a Comment